Assessment Roll exceeds expectations in the face of economic uncertainty says Assessor Larry Stone .

2023 Assessment Roll Growth at $41.2 billion in spite of fewer property transfers and proactive reductions of 19,000 Properties

Santa Clara County, California, July 5, 2023 - 2022 started strong then began to show signs of slowing in the fall. While the pandemic health crisis subsided, the United States economy experienced the perfect storm of high demand and low supply, a jump in consumer prices, and increasing interest rates. Consumer confidence and reduced buying power resulted in a significant drop in the number of property change of ownership transactions. A modest decline in residential property values resulted in a decline in the assessed value for a few property owners. The complex and unpredictable status of both the region’s commercial and residential markets is reflected in this year’s annual assessment roll .

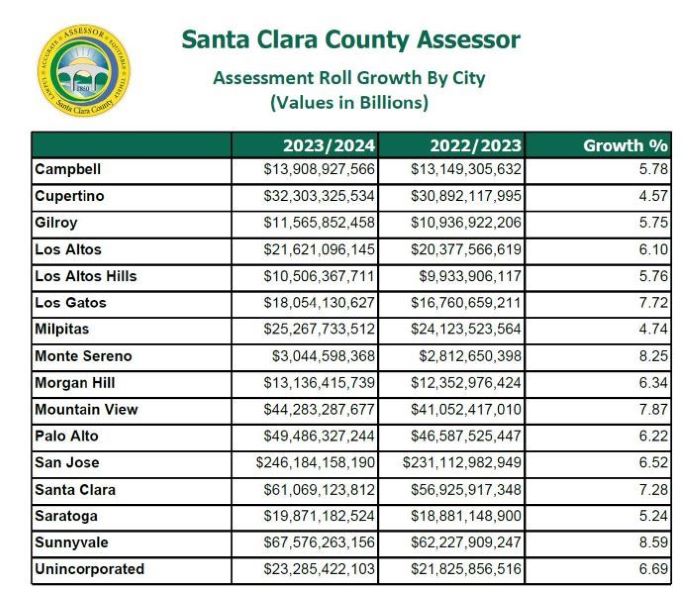

The 2023-2024 assessment roll is comprised of the total net assessed value of all real and business property in Santa Clara County as of the January 1, 2023 lien date, and reflects changes between January 1 and December 31, 2022. This year’s roll reached a record $661.2 billion, a 6.65 percent increase over the prior year, stronger than anticipated growth in County assessments.

The leading contributors to the increase in property assessments are changes in ownership and new construction, which accounted for $21.5 billion and $6.8 billion, respectively. Historically high business property values added $4.7 billion.

Consumer spending is the primary driver of the U.S. economy. Suddenly, the economy came roaring out of the COVID recession. Robust consumer spending combined with widespread product and worker shortages created the highest inflation in 40 years. Consumers couldn’t stop spending and prices wouldn’t stop rising .

Changes in property ownership accounted for more than half of this year’s increase. In early 2022, residential values and change of ownership transactions were at record levels. As the real estate markets cooled and interest rates increased, the number of transactions started to decline and the market values stabilized. In response, the Assessor proactively reduced the assessments of 17,000 residential properties. The “Boomerang” market values and lower transaction levels are expected to adversely impact the 2024 assessment roll .

Technological innovation continues to generate significant investment in the region, including $4.4 billion of office and commercial building acquisitions last year.

New construction is a core component of assessment growth. Several large-scale construction projects were completed, contributing to the increase of $6.8 billion in the assessments of new construction. High-value examples include the Winchester Apartments in San Jose adding $236.5 million to the roll. And the Google Caribbean campus in Sunnyvale added $223.1 million, boosting the City of Sunnyvale’s assessment roll growth to 8.59 percent compared to the County’s total of 6.65 percent .

Silicon Valley was on the precipice of unprecedented new commercial development when an uncertain economy and business outlook caused everything to slow down. While there are many large projects in progress, relatively few new properties have commenced development. The high-profile Google Downtown West project, expected to be the largest single development in San Jose history, is now placed on a temporary pause. In April of 2023, Google issued a statement that they are “still committed to San Jose for the long term and believe in the importance of the development .

The assessment of “business property,” i.e. machinery, equipment, computers, and fixtures, recorded an unprecedented increase of 9.6 percent to $47 billion. Santa Clara County historically has the second-largest business property values in California. Inflation contributed to the unusual increase in the value of business property

Proposition 13 limits the assessment of properties without new activity or transactions to the California Consumer Price Index (CCPI) or two percent, whichever is lower. The final component of the 2023-2024 assessment roll growth is the two percent increase in the assessed value of those properties, adding more than $8.1 billion to the assessment roll

“Even when real estate values are soaring, Proposition 13 limits the increase in assessment to two percent, a significant financial benefit to most property owners,” said Stone. .

<p“As Assessor, my responsibility is to ensure that accurate values are enrolled based upon market conditions. When market value (as of January 1, 2023) falls below the existing assessment, my office is required by law to temporarily reduce the assessed value to reflect the declining market value. This year we proactively reduced the assessment of 17,000 residential properties. When property owners receive their Notification of Assessed Value (NAV) card in the mail this week, they will have an opportunity to review their assessed value and apply for review of their assessment to determine if they meet the Proposition 8 criteria,” said Stone.

This year’s roll includes 19,064 properties in Proposition 8 decline status, totaling $2.8 billion. Of those, 98 percent are residential properties, a majority of which qualified for a reduced assessment due to late-term decline in residential market values .

The 2023-2024 assessment roll is a snapshot of property values as of January 1, 2023. “While residential property values have stabilized recently, high mortgage interest rates and inflation have reduced consumer buying power. With residential sales volume down 20 percent and office vacancy increasing due in part to remote work, the volatile and unpredictable nature of Santa Clara County real estate causes us to question the future of property values,” said Stone .

The Santa Clara County assessment roll closed on time by the statutory deadline of July 1, 2019. For the 17th consecutive year, the Assessor operated below budget, returning $1.3 million unspent back to the County’s general fund.

Beneficiaries of property tax revenue

The major beneficiaries of property tax revenue are public schools, community colleges, cities, and Santa Clara County. Fifty percent of local property tax revenue generated in Santa Clara County goes to fund public education. To find out more about property tax, visit the Property Tax Story” on the County data pages .

Annual Notification of Assessed Value (NAV)

On June 30, the Assessor’s Office mailed annual Notification of Assessed Value (NAV) Cards to 485,944 properties, reporting each property’s 2023 assessed value. The notice serves as the basis for the property tax bill. Santa Clara County is one of only eleven counties in California that provides early assessment notice to property owners. “Most property owners in California learn of their assessed value for the first time when they receive their property tax bill in October,” said Stone.

Requesting a Temporary Reduction in Assessed Value

Property owners who demonstrate their assessment is higher than the market value of their property (as of January 1, 2023) are encouraged to request an informal review of their assessment no later than August 1. “My appraisal staff will complete as many informal reviews as possible before August 15, the deadline for making adjustments that will be reflected on the property tax bill mailed in the fall,” said Stone. To apply for a reduction go to www.sccassessor.org/prop8 .

Property owners who can demonstrate that their assessed value is higher than the market value of their property are encouraged to request an informal review of their assessment. The Assessor’s property appraisal staff will complete as many informal reviews as possible prior to August 1, the deadline for making changes that will be reflected on the property tax bill mailed in the fall. More information is available at www.sccassessor.org.

Assessment Appeals

The annual notice also describes the process for filing a formal assessment appeal by the September 15, 2023 deadline. Residential property owners who decide to file a formal appeal, are encouraged to request their appeal be adjudicated by an independent residential Value Hearing Officer (VHO). VHO hearings are scheduled frequently, allowing for a more rapid resolution .

<p“Property owners who disagree with the assessed value should not wait for the tax bill before filing an appeal, as the tax bill is mailed by the Tax Collector after the assessment appeal filing deadline,” said Stone. More information is available from the Clerk of the Board by calling (408) 299-5088, or going to their website: (http://www.sccgov.org/assessmentappeals).

Go Paperless

The Paperless option, allows taxpayers to securely receive assessment notices electronically. To register, a property owner must have the PIN listed on the annual Notification of Assessed Value, or their log-in credentials if they are already registered. To sign up or log in go to Manager Account Page .